Election Season USA

Election season is upon the USA, and it has become more of an emotional frenzy than a democratic process of people holding their government accountable. November 5, 2018 By: Bobby Casey, Managing Director GWP I might be an expat, but there is something to be said for being above the fray during the US midterm election […]

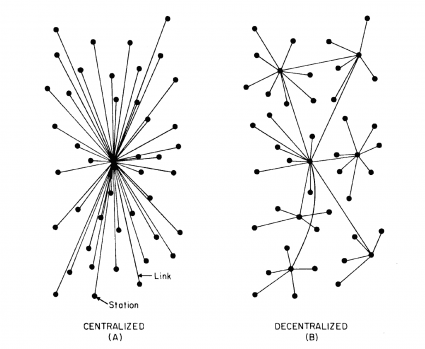

Russia Rolls Out SWIFT Alternative to Global Community

More evidence of a global demand for decentralization: Russia opens up its alternative to SWIFT to international partners. October 22, 2018 By: Bobby Casey, Managing Director GWP Last week we discussed how individual freedom is helped by decentralization technology. But really that is the entire premise behind capitalism, the free market, and individual freedom: that […]

Technology Leads the Way to More Freedom

Technology has been the key to freedom and economic equality for many around the world. The market turns to technology to get out from under the foothold of government and crony corporations. October 15, 2018 By: Bobby Casey, Managing Director GWP Without question, modern civilization has introduced and commoditized many creature comforts. Computers and cellular phones […]

Trojan Horse: Censorship Disguised as Copyright Directive in EU

Is the controversial EU Copyright Directive a Trojan Horse or just a policy meant to target large corporations? September 17, 2018 By: Bobby Casey, Managing Director GWP It’s said that if the government dismantles your gun rights the rest will follow in short order. I can’t help but wonder if that’s what is happening right […]

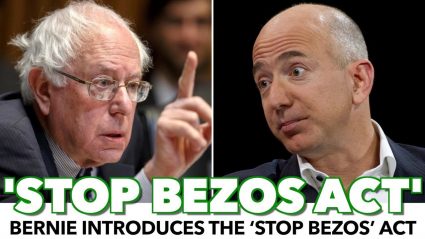

The “Stop BEZOS Act” Won’t Help the Poor

Bernie Sanders had Jeff Bezos of Amazon in his crosshairs when he introduced the “Stop BEZOS Act” in the Senate last Wednesday. September 10, 2018 By: Bobby Casey, Managing Director GWP It’s a page right out of Atlas Shrugged, Bernie Sanders set his sights on corporations with 500 or more employees whose workers may be […]

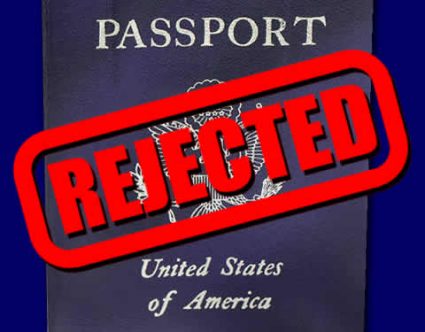

State Department Denying Passports to Americans!

The State Department is denying American citizens their passports because they don’t believe the authenticity of their birth certificates. September 3, 2018 By: Bobby Casey, Managing Director GWP I’ve been writing about some pretty gruesome things coming out of various governments. One was the IRS being able to revoke or withhold passports from those who are […]

Big Brother is Now Invading Your Body…

Your body is being tracked, and you could be unwittingly building a case against yourself! August 28, 2018 By: Bobby Casey, Managing Director GWP Looks like Big Brother isn’t just invading your home and car… he’s now invading your body. More specifically, your heart. During a fire at his home, Ross Compton was glad he […]

Trump’s Trade War Hits Businesses and End Users, but Spares Steel Lobby Cronies

Trump’s trade war is taking its toll. The tariffs are hitting end users and businesses hardest, but the steel lobby cronies seem to be safe. August 20, 2018 By: Bobby Casey, Managing Director GWP Nothing invokes change quite like a swift kick in the pocketbook. There are a few folks out there (myself included) who […]

Entrepreneurs Hold the Solutions for Market Problems

Entrepreneurs and innovators are the key to solving social and material problems. Rather than being met with fines, fees, and regulations, governments should be facilitating their integration… even if that means getting out of the way. August 13, 2018 By: Bobby Casey, Managing Director GWP It seems like whenever an entrepreneur discovers a market demand […]

Growing Demand for Stable Currency Shows World is Ready for Crypto

Crypto offers a decentralized and potentially stable alternative to individuals, businesses and countries away from the traditional fiat currencies. August 6, 2018 By: Bobby Casey, Managing Director GWP I think there might be a subtle directional pull toward sound money. I realize that claim oozes with commitment issues, but it’s not reluctant. The abuse by […]